What Items Are Exempt From Sales Tax In Washington . effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail sales tax or use tax on their. all nonresidents may be exempt from sales tax based on: washington taxes most tangible products, but there can be exemptions! the information below lists sales and use tax exemptions and exclusions. To be absolutely clear about. Vehicles and trailers, watercraft, or farm. Washington taxes the sale of most tangible personal property. in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. For more information on tax exemptions, see our. This means if you’re selling physical items,. The type of item sold (e.g.

from topforeignstocks.com

in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. Vehicles and trailers, watercraft, or farm. The type of item sold (e.g. Washington taxes the sale of most tangible personal property. This means if you’re selling physical items,. the information below lists sales and use tax exemptions and exclusions. For more information on tax exemptions, see our. washington taxes most tangible products, but there can be exemptions! effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail sales tax or use tax on their. all nonresidents may be exempt from sales tax based on:

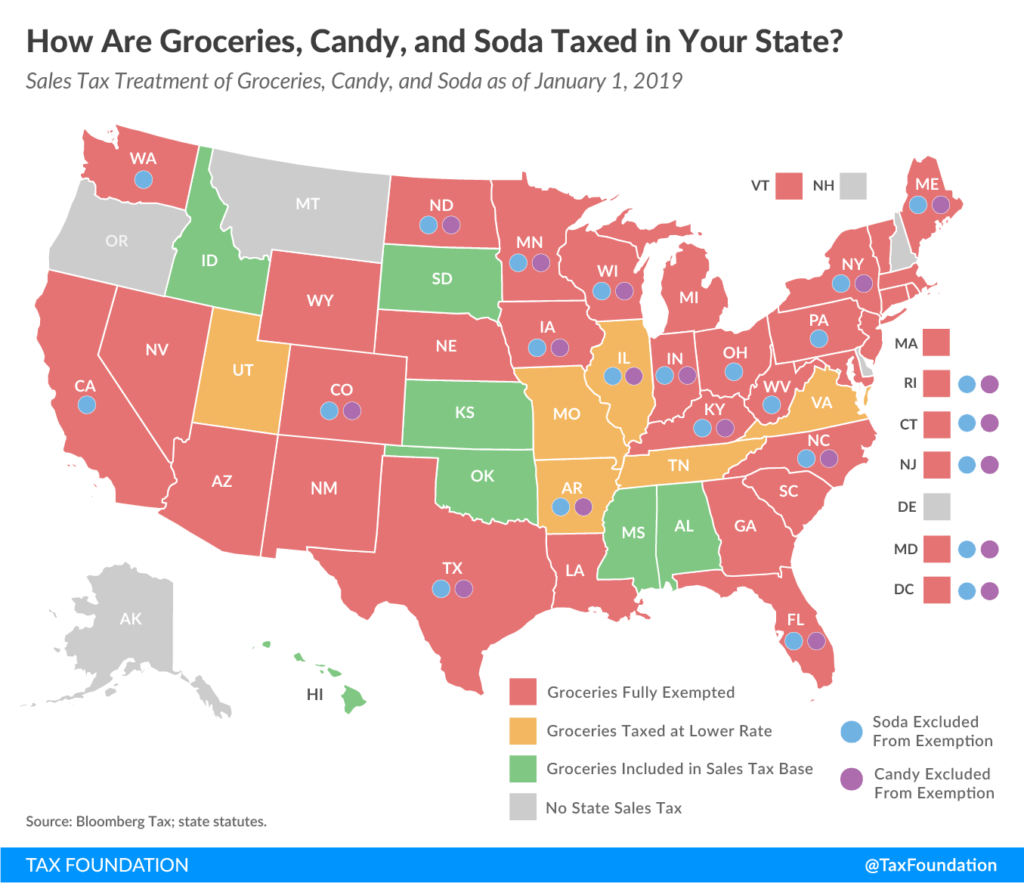

Sales Tax on Grocery Items by State Chart

What Items Are Exempt From Sales Tax In Washington effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail sales tax or use tax on their. washington taxes most tangible products, but there can be exemptions! Vehicles and trailers, watercraft, or farm. the information below lists sales and use tax exemptions and exclusions. For more information on tax exemptions, see our. effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail sales tax or use tax on their. This means if you’re selling physical items,. several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. Washington taxes the sale of most tangible personal property. all nonresidents may be exempt from sales tax based on: To be absolutely clear about. in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. The type of item sold (e.g.

From kgmi.com

Washington ranks highest in nation for reliance on sales tax 790 KGMI What Items Are Exempt From Sales Tax In Washington To be absolutely clear about. the information below lists sales and use tax exemptions and exclusions. Vehicles and trailers, watercraft, or farm. several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. all nonresidents may be exempt from sales tax based on: The type of item sold (e.g. . What Items Are Exempt From Sales Tax In Washington.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates What Items Are Exempt From Sales Tax In Washington several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. all nonresidents may be exempt from sales tax based on: For more information on tax exemptions, see our. washington taxes most tangible products, but there can be exemptions! effective january 1, 2018, certain marketplace facilitators, remote sellers and. What Items Are Exempt From Sales Tax In Washington.

From ezylearn.com.au

Sales Tax Simplified With Xero's TaxJar Integration EzyLearn Pty Ltd What Items Are Exempt From Sales Tax In Washington several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. all nonresidents may be exempt from sales tax based on: washington taxes most tangible products, but there can be exemptions! effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail. What Items Are Exempt From Sales Tax In Washington.

From www.formsbank.com

Sales Tax Exemption List Form printable pdf download What Items Are Exempt From Sales Tax In Washington several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. all nonresidents may be exempt from sales tax based on: washington taxes most tangible products, but there can be exemptions! This means if you’re selling physical items,. To be absolutely clear about. the information below lists sales and. What Items Are Exempt From Sales Tax In Washington.

From www.exemptform.com

Sales Tax Exemption Form Washington State What Items Are Exempt From Sales Tax In Washington To be absolutely clear about. For more information on tax exemptions, see our. effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail sales tax or use tax on their. the information below lists sales and use tax exemptions and exclusions. all nonresidents may be exempt from sales tax. What Items Are Exempt From Sales Tax In Washington.

From www.scribd.com

Sales Tax Exempt Fill in Template Use Tax Taxation In The United States What Items Are Exempt From Sales Tax In Washington Washington taxes the sale of most tangible personal property. For more information on tax exemptions, see our. in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. To be absolutely clear about. several exceptions to the washington sales tax are the majority of agricultural farm products, producer. What Items Are Exempt From Sales Tax In Washington.

From ccsyourauditor.blogspot.com

CCS & Co Plt Guide on Sales Tax Exemption Under Schedule C Persons What Items Are Exempt From Sales Tax In Washington effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail sales tax or use tax on their. This means if you’re selling physical items,. The type of item sold (e.g. washington taxes most tangible products, but there can be exemptions! Washington taxes the sale of most tangible personal property. . What Items Are Exempt From Sales Tax In Washington.

From housedemocrats.wa.gov

The truth about taxes in Washington Washington State House Democrats What Items Are Exempt From Sales Tax In Washington in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. washington taxes most tangible products, but there can be exemptions! all nonresidents may be exempt from sales tax based on: Washington taxes the sale of most tangible personal property. This means if you’re selling physical items,.. What Items Are Exempt From Sales Tax In Washington.

From www.templateroller.com

Form REV27 0032 Fill Out, Sign Online and Download Fillable PDF What Items Are Exempt From Sales Tax In Washington the information below lists sales and use tax exemptions and exclusions. Vehicles and trailers, watercraft, or farm. This means if you’re selling physical items,. washington taxes most tangible products, but there can be exemptions! in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. For more. What Items Are Exempt From Sales Tax In Washington.

From www.yumpu.com

Zerorated and exempt supplies What Items Are Exempt From Sales Tax In Washington the information below lists sales and use tax exemptions and exclusions. The type of item sold (e.g. Vehicles and trailers, watercraft, or farm. washington taxes most tangible products, but there can be exemptions! all nonresidents may be exempt from sales tax based on: To be absolutely clear about. For more information on tax exemptions, see our. . What Items Are Exempt From Sales Tax In Washington.

From www.exemptform.com

Sales Tax Exemption Form Washington State What Items Are Exempt From Sales Tax In Washington all nonresidents may be exempt from sales tax based on: several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. Washington taxes the sale of most tangible personal property. Vehicles and trailers, watercraft, or farm. the information below lists sales and use tax exemptions and exclusions. To be absolutely. What Items Are Exempt From Sales Tax In Washington.

From zamp.com

Ultimate Washington Sales Tax Guide Zamp What Items Are Exempt From Sales Tax In Washington Vehicles and trailers, watercraft, or farm. The type of item sold (e.g. effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail sales tax or use tax on their. washington taxes most tangible products, but there can be exemptions! This means if you’re selling physical items,. all nonresidents may. What Items Are Exempt From Sales Tax In Washington.

From www.softwaresuggest.com

GST Exemption A Detailed List Of Exempted Goods and Services What Items Are Exempt From Sales Tax In Washington Vehicles and trailers, watercraft, or farm. all nonresidents may be exempt from sales tax based on: washington taxes most tangible products, but there can be exemptions! in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. The type of item sold (e.g. Washington taxes the sale. What Items Are Exempt From Sales Tax In Washington.

From help.skygeek.com

Sales Tax Exemptions Tax Exempt SetUp SkyGeek Help Center What Items Are Exempt From Sales Tax In Washington effective january 1, 2018, certain marketplace facilitators, remote sellers and referrers, are required to collect and remit retail sales tax or use tax on their. For more information on tax exemptions, see our. The type of item sold (e.g. all nonresidents may be exempt from sales tax based on: Washington taxes the sale of most tangible personal property.. What Items Are Exempt From Sales Tax In Washington.

From learningschoolhappybrafd.z4.web.core.windows.net

Sd Certificate Of Exemption For Sales Tax What Items Are Exempt From Sales Tax In Washington several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. washington taxes most tangible products, but there can be exemptions! For more information on tax exemptions, see our. This means if you’re selling physical items,. all nonresidents may be exempt from sales tax based on: the information below. What Items Are Exempt From Sales Tax In Washington.

From www.sampletemplates.com

FREE 10+ Sample Tax Exemption Forms in PDF What Items Are Exempt From Sales Tax In Washington To be absolutely clear about. For more information on tax exemptions, see our. Washington taxes the sale of most tangible personal property. Vehicles and trailers, watercraft, or farm. the information below lists sales and use tax exemptions and exclusions. washington taxes most tangible products, but there can be exemptions! all nonresidents may be exempt from sales tax. What Items Are Exempt From Sales Tax In Washington.

From www.slideserve.com

PPT VAT value added tax PowerPoint Presentation, free download ID What Items Are Exempt From Sales Tax In Washington Vehicles and trailers, watercraft, or farm. For more information on tax exemptions, see our. This means if you’re selling physical items,. in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. the information below lists sales and use tax exemptions and exclusions. Washington taxes the sale of. What Items Are Exempt From Sales Tax In Washington.

From www.reddit.com

Sales tax in Washington state? TeslaModelY What Items Are Exempt From Sales Tax In Washington in the state of washington, legally sales tax is required to be collected from tangible, physical products being sold to a. Washington taxes the sale of most tangible personal property. several exceptions to the washington sales tax are the majority of agricultural farm products, producer goods (such as. effective january 1, 2018, certain marketplace facilitators, remote sellers. What Items Are Exempt From Sales Tax In Washington.